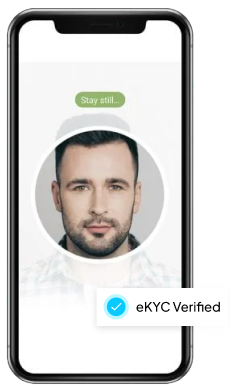

Maximize Accuracy With

eKYC Solution

eKYC The Digital Key to Customer Verification

The System is powered with advanced AI capabilities using PIXL Engine, designed to enhance safety, compliance, and productivity. Our system delivers seamless experiences for both visitors and hosts.

Features of ekyc solution

Paperless:

The service is entirely electronic, eliminating the need for document management.

Consent based:

KYC data can only be accessed with resident authorization through OVD authentication, ensuring resident privacy protection.

Eliminates Document Forgery:

Removing photocopies of documents stored across different premises reduces identity fraud risk and safeguards resident identity.

Inclusive:

The fully paperless and electronic nature of e-KYC, coupled with its low-cost features, enhances inclusivity, facilitating financial inclusion.

Low cost:

By eliminating paper verification, transportation, and storage, the cost of KYC is reduced to a fraction of its current expenses.

Instantaneous:

The service operates entirely on automation, delivering KYC data in real-time without any manual intervention.

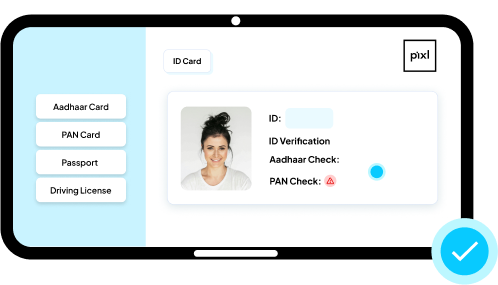

Pixls All in one eKYC solution

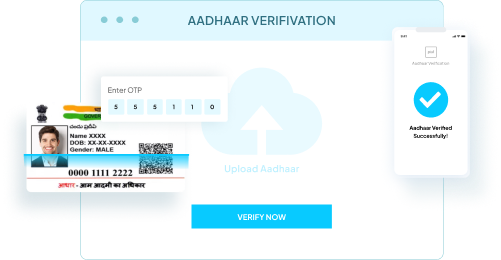

Aadhaar verification

Our robust Aadhaar verification API secures your customer onboarding process. Eliminate fraudulent activity, ensure data accuracy, and accelerate onboarding with our easy-to-integrate solution.

Pan verification

Accelerate customer and vendor onboarding with instant PAN validation. Gain deeper financial insights to make informed decisions. Bulk verification saves time and resources.

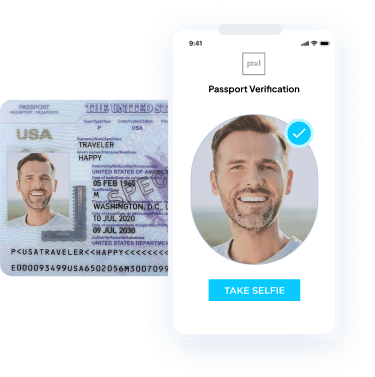

Passport verification

Our user-friendly Passport Verification API simplifies customer onboarding. Eliminate the hassle of manual verification with real-time results. We ensure only legitimate users gain access, enhancing security and building trust. Upgrade your eKYC process with this essential tool.

Frequently Asked Questions

What is eKYC?

What are the benefits of using eKYC solutions?

- Efficiency : eKYC significantly reduces the time and effort required for customer onboarding.

- Cost-Effective : It lowers operational costs by minimizing the need for physical documentation and manual verification.

- Security : eKYC solutions ensure a high level of data security and compliance with regulatory standards.